Getting Started with FIRE (Financial Independence / Retire Early)

Being new to financial independence can feel daunting. This guide helps you get started without inundating you with big words and complex tax strategies. You don't need those to start your journey towards financial independence.

The Basics (Income and Expenses)

To get started you'll need to know your income and expenses.

In addition to your take home pay you should take note of any pre-tax retirement deductions such as 401k. If you get paid regularly you can estimate your what these are each month.

The more predictable your expenses the more easily you can plan. This is really important and you'll want to create a budget if you don't have one already. If you don't have a budget then give zero-based budgeting a shot. If you're unsure if you have a budget, give zero-based budgeting a shot :).

You'll want your take home pay to be larger than your expenses. The bigger the difference the more you'll be able to save. The more you save the sooner you'll reach financial independence.

A reality you'll come to terms with sooner than later is that minimizing expenses is probably the single most important thing you can do. This doesn't have to mean a life of utter frugality but it does get you thinking about how you want to spend your money.

Planning For Retirement

Financial independence means that you're less reliant on working to sustain your life. Most people who are financially independent do have streams of income. Some of that they work for and others are what's called passive (i.e. income from rental properties). Unlike most people they can choose to work on something that interests them and they don't have to do it full-time.

The more you save for retirement the better. But if you're planning to stop working while you're still young (less than 60 years old) you will want to start thinking about what type of retirement accounts will be most useful.

Create a Forecast

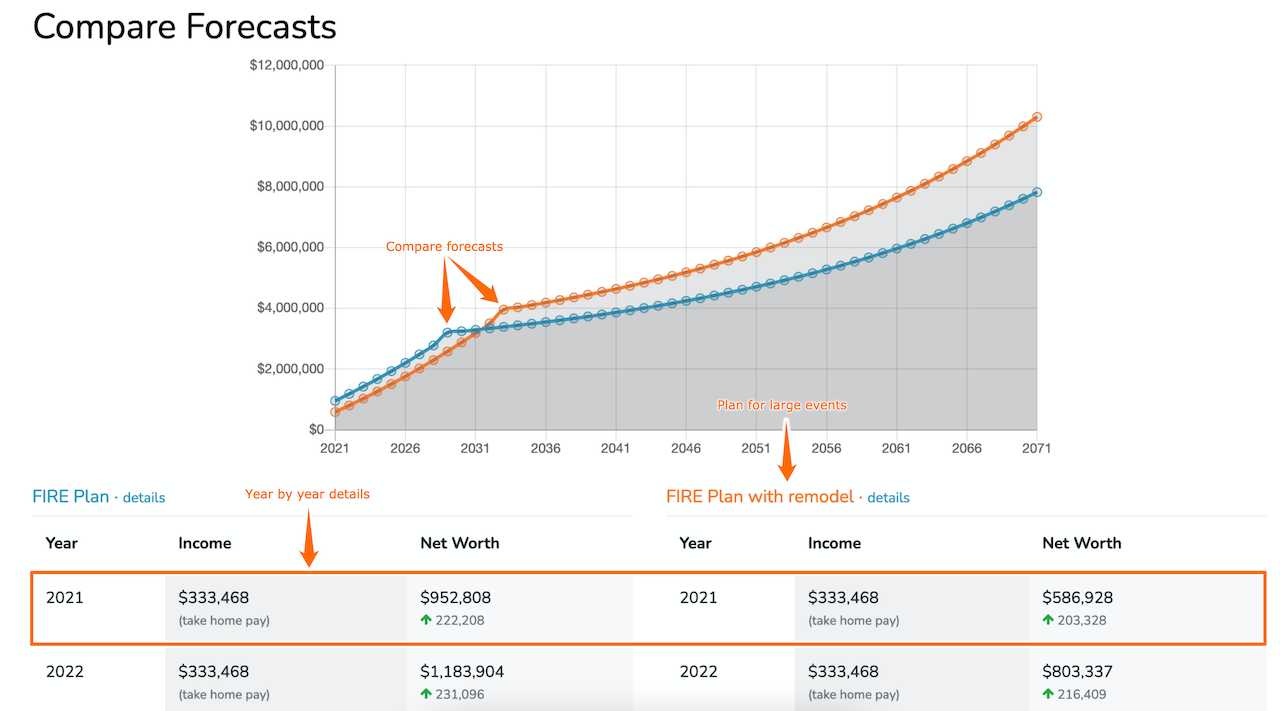

Use all that information to create a FIRE forecast. The forecast shows you how your money will grow. More importantly it will show you when your money will generate enough passive income for you to stop working entirely.

Once you create your first forecast you can then consider ways to make changes to your plan. Create multiple forecasts, compare them with one another and start taking control of your financial future!

It really is that easy to get started.