A Sneak Peak At My Simple Budgeting App

Simple Bank is shutting down and their apps will stop working on May 8, 2021. Follow me over the next 40 days to see if I can build something to replace Simple's budgeting tools before they disappear. Join to get posts delivered to your inbox or follow me on social media.

Read All Of The Posts

- Building a Simple Budgeting Tool As Good As Simple's

- How Do Banks Connect To My Bank Account?

- A Sneak Peak At My Simple Budgeting App

- How I Built a Simple Budgeting App

Scoring Progress So Far

Before getting into the details I wanted to show a working video of the app in action.

I listed 7 goals I wanted to accomplish in my original post. Let's see where we are.

| Goal | Score | |

|---|---|---|

| 1. | I'm not building a bank. This will have to be used as a layer on top of a traditional checking account. | |

| 2. | I do not want to enter transactions manually. | |

| 3. | I like the envelope system and want to have tools that resemble real life envelopes stuffed with cash as much as possible. | |

| 4. | We need something akin to sinking funds that let us accrue money for bi-annual bills like car insurance. | |

| 5. | My wife and I need to be able to access the tools from our phones. | |

| 6. | We do not, nor do we plan to, set up a budget for each month. Our budget doesn't change often and we are lazy. | |

| 7. | It needs to be good enough that my wife uses it. This rules out things like Excel. |

Highlights (What Worked Well)

Automatically Downloaded Transactions - I will schedule transactions to download once a day. It's not real time but should be good enough and I do not have to enter them manually.

Envelopes - Assigning transactions to envelopes is really easy and fast. It actually takes one less tap to do than it did with Simple's app. I'm also displaying the remaining balance for a transaction's envelope right with the transaction itself. This is another optimization I was able to make that the Simple app didn't.

Mobile Ready - It works a lot better and is faster on my phone than I expected. I did have to make a few changes to how envelopes were assigned but they worked well and exceeded my expectations.

Speed - This opens extremely fast on my phone. Faster than my bank app. I also do not need to require Touch ID or a passcode since it only lists my transactions and does not communicate directly with my bank at all.

A Robust Transaction View

I covered how I was able to access bank transactions in my last article. In this article we'll cover how to make use of that information.

I spend 90% of my time, while budgeting, looking at my transactions. I want to see every purchase we've made and which envelope that money came from.

There are 3 pieces of information that help me treat my budget like I would with physical envelopes.

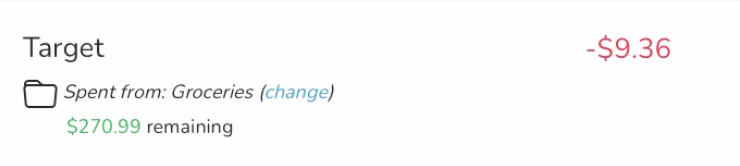

- We spent $9.36 at Target. The red color visually indicates that money was spent.

- The money was spent from the Grocieries envelope.

- The Grocieries envelope has $270.99 remaining. The green color visually indicates that there's money remaining.

The Flexibility Of Choosing An Envelope

Life isn't always predictable and we sometimes need to use money from one envelope to cover an expense whose normal envelope is empty. In doing this it's important to transfer money out of one envelope and into another. The real world example is grabbing the $9.36 from your Entertainment envelope when you have one too many burrito cravings that month.

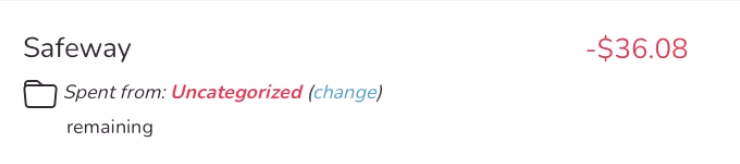

The envelope that an expense was spent from can easily be change. Simply click on the change link next to the envelope the expense was spent from and choose another. This will automatically debit and credit each envelope just as if you physically took money from one and moved it to another.

Some transactions are automatically spent from an expense. This works around 90% of the time which leaves manual intervention for 10% of transactions. These transactions are clearly labeled as Uncategorized. This makes it easy to spot them and assign an envelope to them. There should be zero uncategorized transactions.

What's Remaining?

We're going to start using this in a couple of days. It's remarkable how simple this is and how closely it mimicks real life envelopes. There are several features that I think will be helpful for us and I'll probably add them over the next couple of weeks. But for now, this checks the checkboxes.

- Make it easier to select commonly used expenses like Grocieries instead of always having to scroll to find it.

- Filter to only show Uncategorized transactions.

- Factor time remaining until budget is topped off into each envelope's remaining balance.

These are nice to haves and can be added easily whenever I get the chance.

In the next post I'll give an update as to how well this is working for me and, more importantly, my wife.