Should I Pay Off My Mortgage Early for FIRE?

Note: see our other article on buying a house vs renting.

Is it a good idea to pay off your mortgage early? We're going to show you the pros and cons through a real world example and explain how you can make the comparison yourself.

Generally speaking, you'll hit your FIRE target sooner if pay your mortgage off early. But there are exceptions and each option comes with trade-offs and they can vary based on your situation. This article is to help you understand how your money grows in different circumstances. We're going to cover a lot of information so grab a coffee and buckle in.

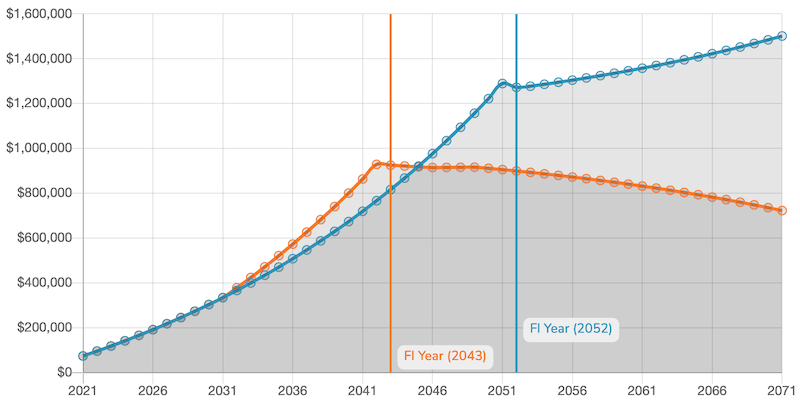

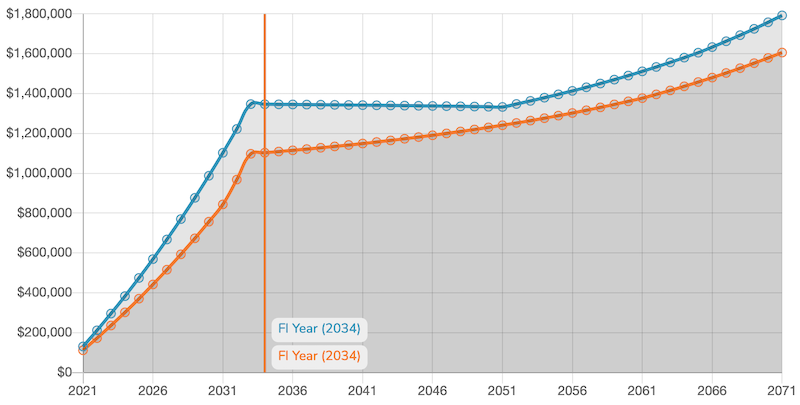

Before we dive in, here is a sneak peak of the example we're using which compares paying your mortgage off in 30 years vs 10 years. You can see the graphs and tables for this example using this forecast comparison.

A Closer Look

Let's take a closer look at the numbers behind the graph above. Both lines are identical except for the mortgage payment and payoff date, highlighted below.

| 30 year payoff | 10 year payoff | |

|---|---|---|

| Monthly take home | $6,000 | $6,000 |

| Monthly expenses | $3,000 | $3,000 |

| Mortgage payment | $1,250 | $2,850 |

| Mortgage payoff year | 2051 | 2031 |

| Debt | $0 | $0 |

| Posttax brokerage balance | $25,000 | $25,000 |

| Pretax retirement balance | $40,000 | $40,000 |

| Posttax retirement balance | $6,000 | $6,000 |

| Investment return interest | 7% (nominal) / 4% (real) | 7% (nominal) / 4% (real) |

| Safe Withdrawal Rate | 4% | 4% |

Short-term, Medium-term and Long-term

In the short term, you see the orange and blue lines start to diverge. The reason for this is because of the $1,600 ($2,850 - $1,250) of your take home pay that's going towards your mortgage each month instead of your investments. This has negative short-term impact on your FIRE goal but frees up $1,250 from your monthly budget 20 years sooner than if you only made minimum mortgage payments.

The early boost you get by allocating more money to investments instead of paying down your mortgage reaps the benefits from compounding interest. Why do you need more money to become financially independent if you keep your loan longer? Carrying a mortgage increases your expense.

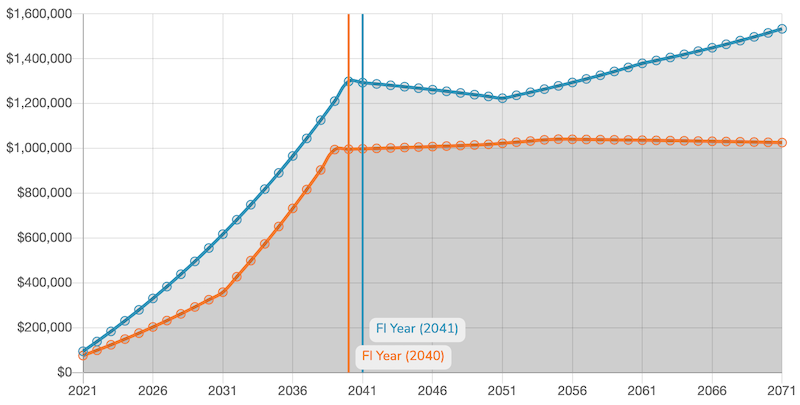

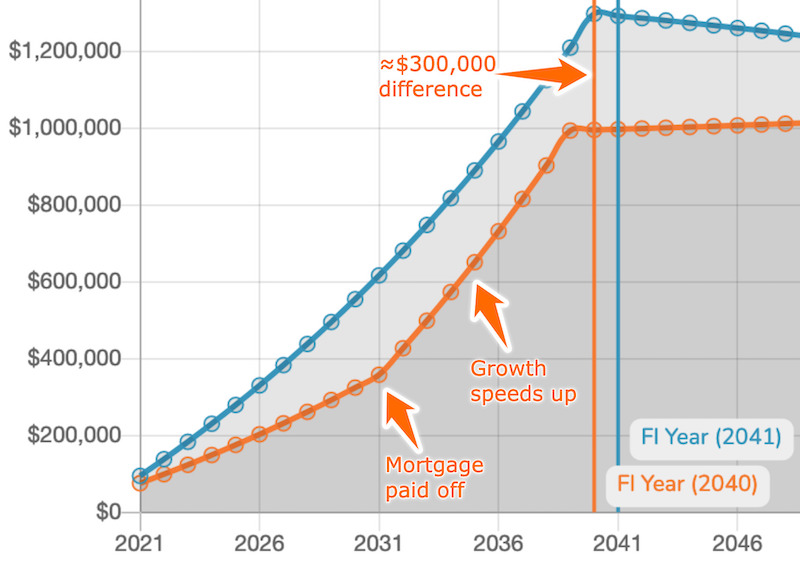

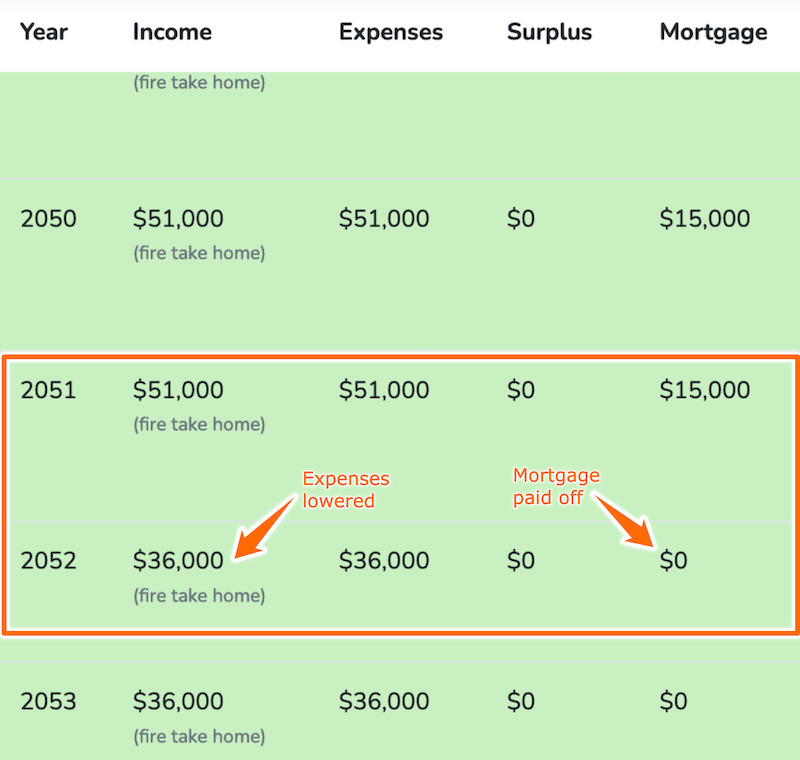

In the medium term, you see that your money starts to grow more quickly once you pay off your mortgage early. The extra $1,250 each month adds up and your net-worth closes in on your net-worth if you chose to pay minimum mortgage payments. Making those extra payments means you hit your financial independence date 1 year sooner but at the cost of around $300,000.

Why do you need an extra $300,000 if paying minimum mortgage payments?

Your expenses are higher as long as you have a mortgage payment. In this case, it's $1,250 higher. That's 29% of expenses including mortgage payment ($3,000 + $1,250).

Note: Equity in your home should not be counted towards the net worth you use in FIRE calculations because you can't liquidate it without purchasing another home or having to start paying rent.

Additional Examples

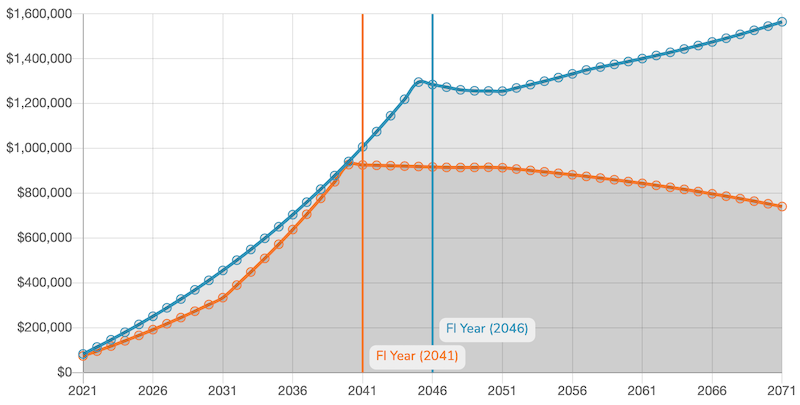

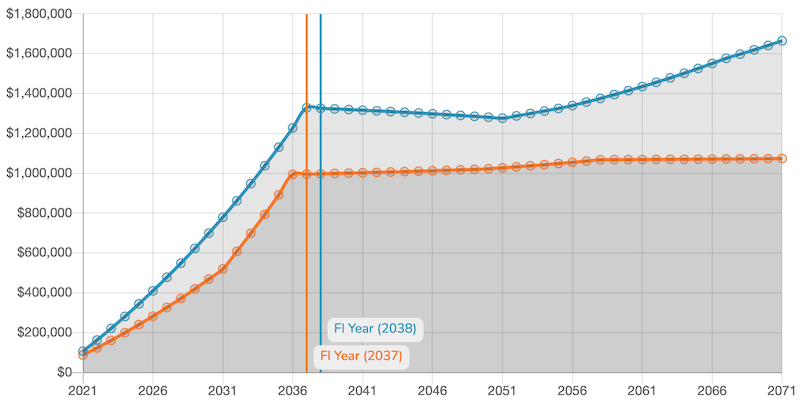

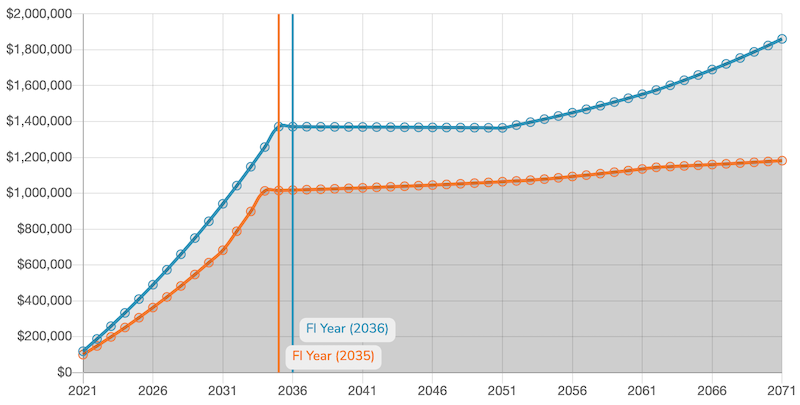

As we said at the start, everyone's situation is different. We ran comparisons with the same numbers but using $4,000, $5,000, $6,000, $7,000, $8,000 and $9,000 monthly income. You'll notice that the difference decreases as income increases (assuming everything else remains the same).

It's Your Turn

What are you waiting for? We encourage you to create your own forecast and join to compare multiple forecasts.