Should I Buy a Home or Rent for FIRE?

Note: see our other article on paying off your mortgage early.

Renting vs. buying is a strongly debated topic. We're going to go through a real world example and explain how you can make the comparison yourself.

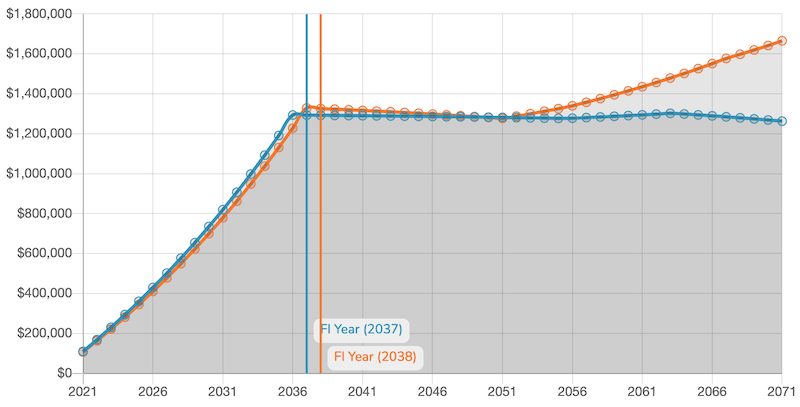

Before we get started, here is an overview of the example we'll be using. It compares renting a home versus buying a home with a 30 year mortgage. You can see the graphs and tables for this example using this forecast comparison.

A Closer Look

Let's take a closer look at the numbers behind the graph above. Both lines are identical except for mortgage / rent and mortgage payoff date, highlighted below.

| Renting | 30 year mortgage | |

|---|---|---|

| Monthly take home | $6,000 | $6,000 |

| Monthly expenses | $3,000 | $3,000 |

| Mortgage / rent | $1,000 | $1,250 |

| Mortgage payoff year | N/A | 2031 |

| Debt | $0 | $0 |

| Posttax brokerage balance | $25,000 | $25,000 |

| Pretax retirement balance | $40,000 | $40,000 |

| Posttax retirement balance | $6,000 | $6,000 |

| Investment return interest | 7% (nominal) / 4% (real) | 7% (nominal) / 4% (real) |

| Safe Withdrawal Rate | 4% | 4% |

Short-term and Long-term

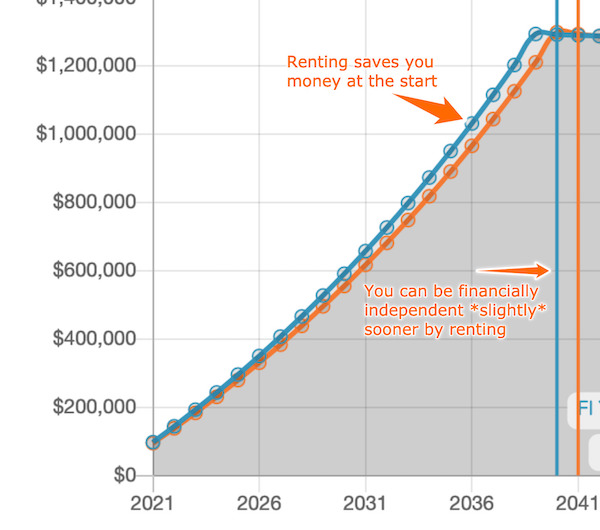

You can typically rent for a lower monthly expense than it costs to purchase a home. In addition to the lower monthly payment, renting has other cost saving benefits such as not having to pay for a broken air conditioner.

There are down sides to renting though. With a 30 year fixed mortgage you'll lock your monthly payment for 3 decades. Meanwhile, rents will continue to increase during those same 3 decades at around 3% per year. This means that renting a $1,000 home in 2020 will cost you $2,400 in 2050.

You're also not building any equity in your home. Equity in a home does not typically factor into financial independence forecasts unless you plan to downsize or move to a lower cost of living city. But equity is good to have nonetheless.

The minor short term benefits can be seen in the diagram above. You'll save a few thousand dollars a year which helps you build up more liquid savings. This can even lead to reaching financial independence slightly sooner.

But it's clear that the short term benefits are not big.

Note: inflation for rent was not factored in at the time of this article.

What about long-term benefits if the short term benefits are small?

You continue to see small benefits of renting due to the lower cost, even after you reach financial independence. However, things change once you pay off your mortgage. At this point your expenses drop drastically (25% in our example). The lower expenses cause your nest egg to start an upward trajectory. If you fast forward 50 years you'll have $320,000 more in your nest egg if you had purchased your home.

By the time we look forward 50 years you're likely thinking about leaving an inheritance to your heirs and the equity in your home starts to matter. It adds a significant amount to the already larger nest egg. Using 2% appreciation, a home purchased for $300,000 would be worth over $800,000 in 50 years.

Note: Equity in your home should not be counted towards the net worth you use in FIRE calculations because you can't liquidate it without purchasing another home or having to start paying rent.

Additional Examples

Since everyone's situation is different, we ran comparisons with the same numbers but using $4,000, $5,000, $6,000, $7,000, $8,000 and $9,000 monthly income. You'll notice that the difference decreases as income increases (assuming everything else remains the same).

It's Your Turn

What are you waiting for? We encourage you to create your own forecast and join to compare multiple forecasts.